Buying a car in Russia is not only a joy, but also a huge responsibility. The presence of a vehicle in a person forces the owner to spend money on the maintenance of movable property. It is necessary to pay for maintenance, repair a car, as well as pay for vehicle registration and insurance. But that is not all. Today we will be interested in transport tax in the Altai Territory. What needs to be remembered by each citizen? And by what date will you have to pay the appropriate tax payment? Practice shows that there is nothing difficult or incomprehensible to understand the road tax. In reality, everything is simpler than it seems at first glance. The legislation of the Russian Federation provides clear information on tax accruals.

a brief description of

Transport tax in the Altai Territory is an annual payment levied on all owners of vehicles equipped with motor engines. There are exceptions, but we will consider them a bit later.

A distinctive feature of the road tax is that it is managed by the municipalities. This means that the rates for calculation, as well as the conditions for the provision of benefits will be determined by regional legislation. We will try to fully study the data relevant in the Altai Territory.

When ordinary citizens pay

All taxpayers in Russia are divided into legal entities and individuals. Let's start with the second. They are most often interested in road tax accruals.

Transport tax in the Altai Territory must be paid before the first of December. This deadline is set in 2019. Citizens who do not meet this deadline will be considered debtors. The presence of tax debt, as a rule, leads to certain consequences. We will study them later.

When do companies pay?

The Law "On Transport Tax" in the Altai Territory also sets the deadline for payment of the corresponding accrual by organizations. They are given more time to implement the task.

Today, the organization must pay the car tax until February 5. However, she will also have to make advance payments. They are produced no later than a month after the end of a reporting period.

Vehicle Types

In order to calculate the transport tax in the Altai Territory, it is necessary to take into account that transport is different. Depending on its category, the final payment amount will change. More precisely, the procedure for performing the corresponding calculations.

Today, transport is divided into ordinary and luxurious. The second type of movable property is subject to increased road tax. For elite vehicles you need to pay more, which is quite logical.

Luxury transport is considered, the cost of which exceeds three million rubles. In this case, only the price indicated by the manufacturer is taken into account, and the amount specified in the vehicle sales contract does not affect the tax in any way.

Important: annually the list of elite vehicles is compiled by the Ministry of Industry and Trade. You can view data for the current year from March-month.

Data required for calculations

To calculate the transport tax in the Altai Territory, it will be necessary to clarify some data about the car or other movable property. What can you do without?

In order to successfully calculate the road tax, a citizen is advised to clarify:

- how much is the vehicle;

- year of manufacture of a car;

- how many people own the property (per year);

- tax rate;

- vehicle engine power;

- tax increase ratio.

It is also important to know where the transport is registered. In our case, we will focus on the registration of vehicles in the Altai Territory. Further, we assume that all of the above information is received.

We consider tax for individuals

Payment of transport tax in the Altai Territory is carried out before the dates indicated above. After them, a citizen or organization will be considered a debtor. And so you have to face the serious consequences of the resulting debt.

To calculate the tax on cars you need to know a few simple formulas. Let's start with the procedure for calculating the corresponding payment for individuals.

In this case, the person is recommended to do the following:

- Time of ownership of transport for the year divided by twelve.

- Multiply the resulting quotient by the engine power, and then multiply this product by the tax rate.

- Multiply the received figure with the coefficient of increase in tax accrual. It is easy to guess that this formula is used exclusively for luxury cars. To calculate the tax on vehicles of the usual type, it is enough to simply abandon the last mathematical action.

Practice shows that there is nothing difficult in calculating taxes. Especially if you prepare in advance for the appropriate process.

Estimates for organizations: formula

The calculation of the transport tax in the Altai Territory with the right actions is very simple. True, if we are talking about calculations for organizations, it will be necessary to slightly modify the formula indicated above. More precisely, improve it.

What transport tax in the Altai Territory will the organization pay? To give the most accurate answer, you just need to multiply the figure obtained by the previously given principle by the share of the organization’s rights to the vehicle, as well as subtract the benefits. Payments for "Plato" will also have to be taken away from the resulting work.

Almost automatic

Calculating the transport tax in the Altai Territory, as we have already found out, is quite easy. The previously proposed scenarios do not differ in their accuracy. More precisely, citizens at the risk of performing mathematical operations risk being mistaken.

In order not to encounter problems, a person is recommended to use special Internet services. They are called tax calculators. One of these is located on the official tax page. We will use it further.

To calculate the road tax in Russia in a similar way, you will have to perform the following steps:

- Find the tax calculator in the "Services" section on the website of the Federal Tax Service of the Russian Federation.

- Select the "Transport tax" section.

- Indicate the information requested by electronic form. It prescribes the previously specified data, excluding the tax rate and increasing ratios.

- Click on the button responsible for starting the calculation.

All that remains now is to carefully study the information presented to attention. The system itself will calculate the tax on the vehicle, and then display it on the screen. Quick, easy and very convenient! And most importantly, free and reliable.

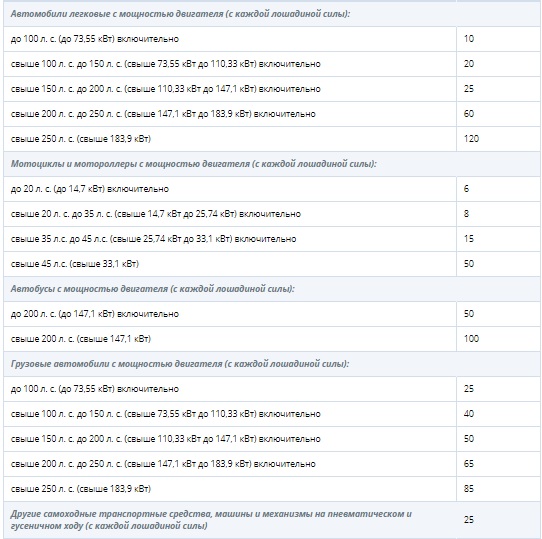

Tax rates

A huge role for the above calculations is played by transport tax rates. In the Altai Territory, they will not be too high in 2019. You can see some of them below.

From year to year, tax rates in Russia in each region are reviewed. They tend to rise.The above data are for informational purposes only. And therefore, they may turn out to be invalid at one moment. In order to prevent mistakes in calculating the road tax, it is enough to clarify the tax rates in the regional tax service.

Federal benefits

It is also worthwhile to clarify the benefits of transport tax in the Altai Territory. They are divided into regional and federal. Let's start with the latter.

Exempt from tax on vehicles:

- all vehicles without motor engines;

- property of up to one hundred horsepower, if acquired through social security;

- vehicles equipped and used for transportation / driving by disabled people;

- government cars;

- TS of special services;

- organizations engaged in international transport;

- agricultural transport;

- vessels entered in the register of vessels.

For objects removed from the register, as well as for stolen cars, the corresponding payment is not made by law. There is nothing difficult or incomprehensible to understand in this.

Regional benefits

Is it necessary to pay transport tax to pensioners in the Altai Territory? To give the most accurate answer to such a question, a citizen will have to take into account regional benefits.

At the moment, retirees by age may not pay tax on cars with a capacity of up to 100 "horses", as well as on motorcycles up to 35 hp. The same applies to people with disabilities of all categories, heroes of the country, gentlemen of the Order of Glory, as well as veterans. Persons who became victims of the Chernobyl accident are exempted from having to pay tax.

Large families also do not pay car tax. Only one of the parents / guardians / adoptive parents can receive the benefit. This takes into account all children, even adults. If there is a disabled child in the family, one of his legal representatives is also exempted from tax payments on vehicles.

What if the car is registered to a minor? In this case, the child owner, if he is not 18 years old, does not pay the tax on the car. But in practice, such a payment is sometimes asked to be made by its legal representatives.

Responsibility for non-payment

What will happen if you do not pay the transport tax in time in the Altai Territory? From the first day of delay, the accrual of interest begins. There is no way to avoid this.

Also the debtor will be fined. The size of the fine directly depends on the conditions under which the event occurred. If the delay is deliberate, you will have to pay forty percent of the amount owed, otherwise twenty.

A debtor can be sued if the amount of the road tax debt exceeds three thousand rubles. After this, the FSSP will "communicate" with the person. This service is involved in the arrest of property of someone who did not pay tax or a fine on time. Also, the corresponding object can later be sold to pay off the debt. Blocking bank plastics and accounts also occurs.

But the bailiffs can no longer write off money from the account to pay off tax debt. In any case, tax delays are best avoided. This is the only way a citizen or company can hope for the absence of problems with the Federal Tax Service.

Instead of a conclusion

We reviewed transport tax benefits in the Altai Territory. Information was also presented to help calculate the size of the relevant payment. Now it’s clear how to act in one case or another.

Paying taxes is recommended in advance. Money must be received by the Federal Tax Service by the dates indicated earlier. Otherwise, do not get rid of the penalty. In order to prevent tax overdue, it is necessary to regularly check the debt on the "State Services" and the website of the Federal Tax Service.