Young people under 30 often have bad financial habits, due to which they constantly spend all cash receipts and cannot accumulate a large amount of funds. They pay too much attention to entertainment and meeting their needs without thinking about the future, but such behavior can lead to poverty. Therefore, several such habits can be distinguished, which should be eliminated as soon as possible.

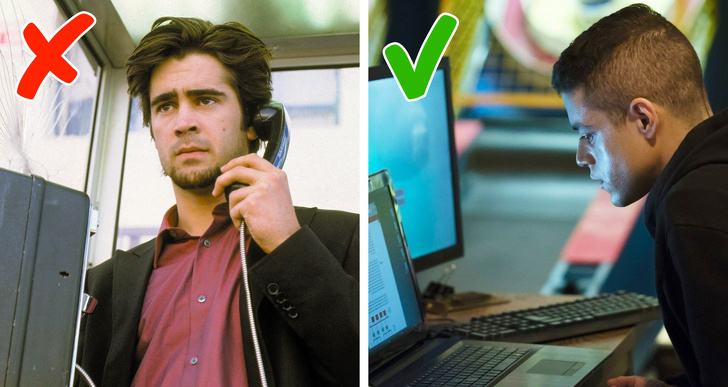

Making international calls

Many young people have acquaintances and friends in different countries of the world. To communicate with them, they can use different programs that allow you to communicate via the Internet, but sometimes they make international calls.

You have to spend too much money on these calls. Often the fee is so high that it is equal to half the monthly income. Sometimes such calls are made by fraudsters whose main purpose is the theft of money of other persons. Therefore, to reduce costs, it is recommended to use computer programs, for the use of which you do not need to pay money.

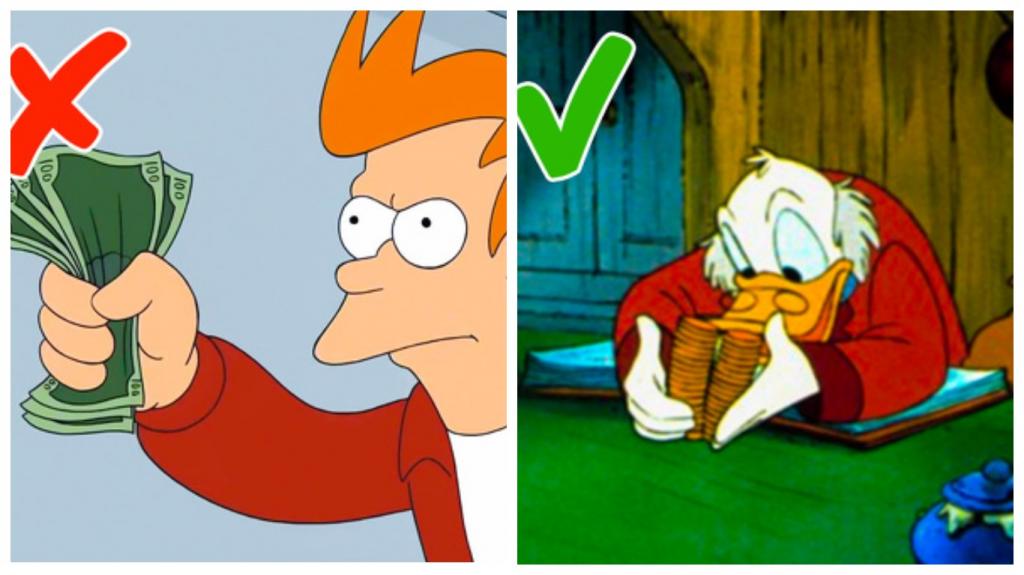

Making mindless and spontaneous purchases

Many people have this bad financial habit. After receiving a salary, young people can make a major purchase without thinking about what they will live on for a month.

Statistics show that most often people regret it is about spontaneous purchases. Financial experts recommend making only the planned large acquisitions. To do this, you need to make sure that the person really needs a particular product.

Often, people use purchases to solve psychological problems. This is due to low self-esteem or problems from childhood. Therefore, such a problem will have to be solved with the help of an experienced psychologist.

Opt out of vacation planning in advance

If you book vouchers in advance, then you can count on a reduced cost for early booking. Additionally, you can calculate exactly how much money will be needed for the trip.

But many young people prefer to use last minute packages, so they decide to visit a resort just a few days before the holidays. This decision is considered incorrect, since it is likely to lose most of their savings.

Due to the proximity of the trip, large amounts will be charged for tickets for transport or hotel accommodation. Therefore, to save money, people should plan their travels in advance.

Payment of various subscriptions

Subscriptions for watching movies or listening to music are expensive. But some people do not hesitate to buy these subscriptions. If there are several subscriptions, then there are too high monthly expenses. Therefore, you can simply use different services that provide the opportunity to watch movies or listen to music for free.

Making bulk purchases

Some people are sure that they save by making bulk purchases. This is especially true for products with a long service life.

But in fact, through such purchases, people acquire many unnecessary things. If a person has a lot of soap, toilet paper or other items at home, he will not be able to change his tastes for a long time.

Opt out of loyalty programs

Many stores and organizations offer discount cards or other ways to reduce the cost of goods or services. But young people do not want to understand the rules for using these loyalty programs.Therefore, they cannot reduce the cost of various goods and even air tickets.

Lack of bargaining skills

Many sellers offer the opportunity to bargain, but proud young people refuse to humiliate themselves, so they buy goods at their original cost, paying a substantial amount for them. Any person can learn this skill, and it allows you to save money.

Refusal to receive advice from relatives

Some people planning a major acquisition tend to make their own decisions, so they don’t consult with relatives and friends. This often leads to serious errors. It is advisable to consult with more experienced people, so as not to spend a lot of money on unnecessary goods.

Wasting money on cigarettes, fast food and alcohol

These bad habits not only cause serious harm to health, but also worsen a person’s financial situation. This is because cigarettes and alcoholic beverages are expensive. Therefore, it is advisable to abandon these bad habits.

If we get rid of negative financial habits, we can note an improvement in the financial condition of any person. This will allow you to accumulate a large amount and more rationalize your savings.