Each person planning to purchase a transport should think in advance whether he will be able to maintain this movable property. The thing is that in addition to maintenance, you will have to pay tax annually. It is called transport. This payment is regional in nature. This means that its benefits and rates are determined by each city separately. This article will focus on transport tax in the Nizhny Novgorod region. What should a citizen who has registered his vehicle in this region know? What benefits and under what conditions can he count on?

What determines the size of the payment

To begin, consider the transport tax in general. This information is useful to residents of the Nizhny Novgorod region. The thing is that the principles of providing benefits, calculation and payment of the corresponding tax are the same in all cities. And only beneficiaries, tax rates, as well as the time limit allocated for transferring funds for cars to the state treasury, depend on the regional authorities.

What generally determines the amount of tax on a car? At the moment, the rate, as well as engine power, is of great importance for this payment. The more powerful the vehicle, the more you will have to pay for it.

Luxury cars in Russia are taxed. This is done in order to replenish the regional budget, as well as to motivate the population to purchase domestic cars.

Who should pay

Almost every owner of vehicles subject to mandatory registration with the authorized bodies should pay the transport tax in the Nizhny Novgorod Region. The exception is only beneficiaries, but we will talk about them later.

From the above it follows that both an individual and a legal entity must pay for a TS. Entrepreneurs who own vehicles are also charged the appropriate tax.

Important: if the owner of the movable property is a minor, his legal representatives will have to pay for it.

When to pay to citizens

Transport tax in the Nizhny Novgorod region must be paid before a certain date. After it, a citizen or organization is considered to be debtor, additional sanctions are applied to them in order to collect debts. But up to what date should I deposit funds for transport owned by an individual?

To date, the relevant payment must be made before December 1, 2019. Money must be paid so that it arrives to the tax recipient before the specified date.

When do organizations pay

Special attention will have to be given to organizations and entrepreneurs. They in the Nizhny Novgorod region pay transport tax a little differently than individuals.

According to current laws, a legal entity must pay vehicle tax by April 15, 2019. Advance payments for the relevant tax charge are made no later than the end of the month following the reporting period.

What will happen if you do not pay

Many are interested in what threatens to avoid tax on vehicles in Nizhny Novgorod. The thing is that the sanctions applied to a person or organization are the same for all cities of the Russian Federation. Therefore, the relevant information will be equally useful to residents of Russia as a whole.

For tax arrears have to prepare for:

- Charge interest. This sanction begins to apply from the first day of tax arrears.

- The fine. If tax evasion was deliberate, you will have to pay forty percent of the debt, otherwise only twenty.

- The arrest of property. This measure of dealing with the debtor begins, as a rule, with the accumulation of debt in the amount of three thousand rubles.

- Lock bank cards and accounts. It is applied in the same way as the seizure of property of a debtor.

- I will prohibit leaving the country. You can get it when you create a significant debt, not necessarily tax.

In addition, the seized property may be put up for sale, and the proceeds from the transaction may be used to repay the debt. If after that something remains, the money will be given to the former owner of the sold property.

What year do they pay

It is also worth paying attention to the period for which the transport tax is paid. This is important information for those who purchase a vehicle from hand.

Citizens pay taxes for the previous year. This means that after buying a vehicle, the need to pay the corresponding tax arises only for the next calendar year. In 2017, they pay for 2016, in 2018 for 2017, in 2019 for 2018 and so on.

Federal benefits

Now we find out what are the benefits of the transport tax in the Nizhny Novgorod region. Let's start with federal beneficiaries. They can receive exemption from the corresponding payment in any city of the Russian Federation.

Do not pay for cars can:

- owners of vehicles purchased with the support of social services, if movable property is not more powerful than a hundred "horses";

- owners of a car that was equipped for use by people with disabilities;

- organizations involved in the transport of goods and passengers;

- public services;

- special services;

- owners of motor boats up to 5 "horses".

It is also not required to pay for a vehicle that has been stolen. Agricultural transport also does not provide for taxation. But that is not all. The Nizhny Novgorod region has its own benefits. And now we learn about them.

Regional benefits - discounts

In reality, everything is simpler than it seems. Are benefits provided to pensioners of the Nizhny Novgorod region? Some categories of citizens pay part of the transport tax in this region, while someone is completely exempt from it.

Owners of passenger vehicles with engine power up to 150 liters can count on a discount. with., as well as motor boats up to 30 "horses", if they relate to:

- retirees;

- disabled people;

- participants and victims of disasters (in Chernobyl and on the "Mayak");

- participants in the dumping of radioactive waste into the Techa River;

- to citizens from high risk units.

In this case, a citizen or organization will be able to reduce the studied payment by 50 percent. No more, no less.

Also, a similar discount in the Novgorod region receive companies that:

- Engaged in international transport to non-CIS countries;

- use vehicles using gas engine fuel.

No one else gives discounts in Novgorod. Certain categories of taxpayers simply can count on a complete exemption from the corresponding tax charge.

Regional "bonuses" - exemption from payment

The Law of the Nizhny Novgorod Region "On Transport Tax" helps to understand what citizens and companies can count on in a particular case. There are a lot of benefits in this region. And, as already mentioned, some categories of taxpayers may not pay tax on vehicles.

The relevant exemption at the moment is:

- to veterans;

- heroes of the country;

- cavalry of the Order of Glory;

- honorary citizens of the Nizhny Novgorod region;

- leshozes;

- participants and invalids of military operations;

- parent or guardian of a disabled child;

- parent or adoptive parent in a large family.

Usually the corresponding "bonus" applies to vehicles up to 150 "horses", boats - up to 30 liters. S., motorcycles - up to 36 liters. with. There is nothing incomprehensible or difficult to apply for benefits. The main thing is to prepare in advance for this process.

Counting Formulas

But first, find out how to understand what kind of transport tax in the Nizhny Novgorod region will have to pay the owner of a particular vehicle. How to calculate the corresponding payment?

To do this, you have to use a simple formula. Instructions for its use are as follows:

- Find out how many months in a year a person owned movable property.

- Divide the corresponding number by 12.

- Clarify the tax rate, and then multiply it by the amount of horsepower of the vehicle.

- Multiply the indicators obtained in the first two steps.

- If the vehicle is luxurious, multiply the corresponding work by a coefficient of increase.

- To take away the privileges laid down for the citizen.

In fact, everything is simpler than it seems. In the case of legal entities, before deducting benefits, you need to multiply the work received by the company's share of ownership.

In order not to be mistaken

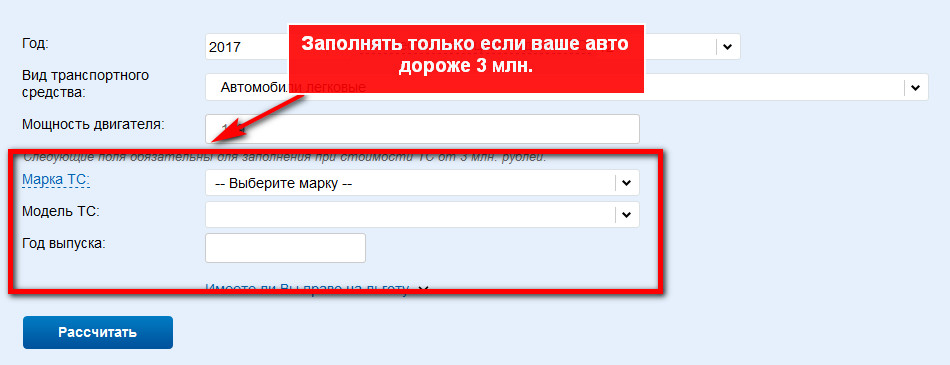

According to the proposed principles, it is possible to calculate the transport tax in the Nizhny Novgorod region. But it’s better to act differently. Namely, use a tax calculator. It helps to cope with the calculations without errors and in a few minutes.

It is best to use the online service from the Federal Tax Service of the Russian Federation. It is on the official page of the Tax Service of the country.

To calculate the tax on vehicles, you will need:

- Open a tax calculator on the site.

- Select the option "Transport tax".

- Indicate data on movable property. Usually it is necessary to choose the region of registration of the vehicle, the year of its release, capacity, as well as the cost of the object. Do not forget about the tenure of the car and the year for which you want to pay.

- Click on the button responsible for starting the processing of the request.

After a few seconds, the amount of tax payable will appear on the screen. Very comfortably. And no need to think about transport tax rates in the Nizhny Novgorod region. Fast, easy and free. The service works around the clock, which allows you to make calculations at any time.

About bids

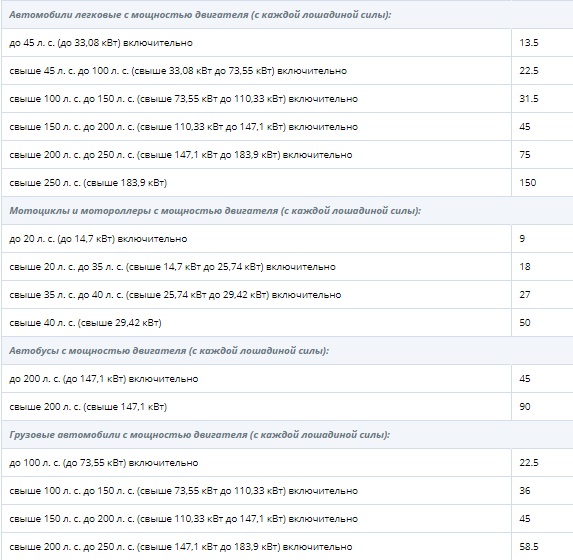

What else needs to be remembered for each car owner? For example, transport tax rates in the Nizhny Novgorod region. They change annually, as a rule, in a big way.

Above you can see the tax rates on vehicles in Novgorod that are currently applicable. They are presented for informational purposes and it is not recommended to consider them 100% reliable. Tax rates on transport tax in the Nizhny Novgorod region may vary. Therefore, it is better to check with the Federal Tax Service shortly before calculating the corresponding payment.

Rules for applying for benefits

To calculate the transport tax in the Nizhny Novgorod region, as you can see, is not as difficult as it might seem initially. The main thing is to clarify the data on the transport and its owner.

And how to draw up the privileges set for the taxpayer? At the moment, it is recommended to adhere to the following algorithm of actions:

- To prepare the documents stipulated by the state.

- Write an application for the provision of vehicle tax benefits.

- Contact your local tax office with prepared certificates and petitions.

- Wait a while.

If everything is done correctly, a citizen or organization will be granted a tax exemption on vehicles. Only a taxpayer can count on a “bonus” for only one object of movable property of one type or another. For example, for one boat and a car. If a person owns several cars, he can indicate in the application which benefits to apply.

Documents for benefits

We studied the benefits of transport tax in the Nizhny Novgorod region. And how to arrange them, now it’s also clear. But what documents come in handy for the appropriate venture?

The list of references directly depends on the specific life situation. The following documents may be useful to a citizen:

- identification;

- certificates of ownership of the vehicle;

- disability statements;

- evidence of a "preferential title" (newspaper clippings, awards, and so on);

- statement of established form.

Practice shows that registration of transport tax benefits in Russia is not the most difficult task. The main thing is to prepare for this operation in advance.

Important: in order to prevent mistakes, it is better to specify the documents for the benefits of tax on cars in the regional branch of the Federal Tax Service of the Russian Federation.

Conclusion

Does the transport tax provide benefits to pensioners of the Nizhny Novgorod region? The answer to such a question will no longer put a person in an awkward position. Now everyone can quickly understand what he can count on when registering a vehicle in Nizhny Novgorod.

It is worth paying attention to the fact that the car tax is calculated without taking into account the registration of the vehicle owner. The calculation is made according to the principles and rates of the region in which the machine is registered. Fortunately, setting up transport outside the place of residence of its owner is a rather rare occurrence. And it can cause a lot of trouble.

You can check and pay taxes on vehicles through "State Services" or through an account on "Tax.ru". It is also proposed to contribute funds to the state treasury using:

- payment terminals;

- electronic wallets;

- ATMs

- Internet banking

- cash banks;

- service "Payment of public services".

Some payment methods include a commission. Through ESIA, you can pay taxes at no additional cost.