Tax liabilities are a sphere of life that causes a lot of questions for the modern population. Some tax accruals are regularly subject to adjustments, which leads to ignorance of the population. Today we will be interested in the transport tax in Voronezh. What should car owners expect? What benefits do they have? How to arrange them? The answers to all this and not only will be surely presented below. With proper preparation, there should not be any problems. In any case, if you adhere to a certain algorithm of actions.

a brief description of

A car tax in the Russian Federation is an annual payment made by owners of vehicles with motors. Typically, tax is levied on all vehicles with rare exceptions.

The peculiarity of this tax is that the rates and benefits on it are determined not at the Federal level, but at the regional. Therefore, each region will have its own rules for calculating, paying and providing benefits for the corresponding payment.

We will be interested in transport tax in Voronezh. In general, it will be calculated according to the same principles as in other cities of the country, but with certain regional characteristics. In fact, everything is simpler than it seems initially.

How much to pay

The first thing to remember is the timing of paying the car tax. If delays are allowed, the citizen will be motivated in every way to pay off the debt. The measures taken are a lot of trouble in real life.

Individuals and legal entities make appropriate payments at different times. Ordinary citizens are currently paid for owned cars until the first of December. You can contribute to the state treasury earlier, but not later. In Voronezh, this payment is made until the second of December.

Organizations pay transport tax until February 5th. They do not make advance payments. Although, in some regions this phenomenon takes place. And Voronezh is no exception.

Here organizations pay for the first quarter of 2019 until April 30, for the second - until July 31, for the third - until October 31. And for the last quarter of this year, companies pay vehicle tax until February 1.

If late payment

Transport tax in Voronezh and the region must be paid on time. If this is not done, you will have to face certain sanctions. They are used to motivate the debtor to pay the debt.

From the first day of tax overdue, interest will be charged on it. She daily increases the amount of debt. This means that the longer a citizen or organization does not pay, the more they will have to give in the end.

Sometimes taxes are not paid by mistake or ignorance of the population. In this case, an additional penalty will be imposed in the amount of twenty percent of the debt.If the tax authorities can prove intentional tax evasion, you will have to pay 40% of the debt.

As soon as the amount of debt reaches three thousand rubles, a citizen can be sued. After that, clerical work will begin, and then it will be transferred to the bailiffs. This service may seize a citizen’s property or bank accounts. Additionally, the vehicle owner may be prohibited from leaving Russia.

Important: encumbrances will be lifted after full repayment of the debt.

What you need to count

The calculation of the transport tax in Voronezh is carried out according to generally accepted principles. The main thing is to prepare in advance some data for further mathematical operations. Without them, the desired result cannot be achieved.

Ideally, for the successful calculation of tax on vehicles, you need to clarify:

- car cost;

- vehicle year of manufacture;

- the term of ownership of the vehicle in the selected year;

- vehicle tax rate;

- amount of horsepower in a car engine.

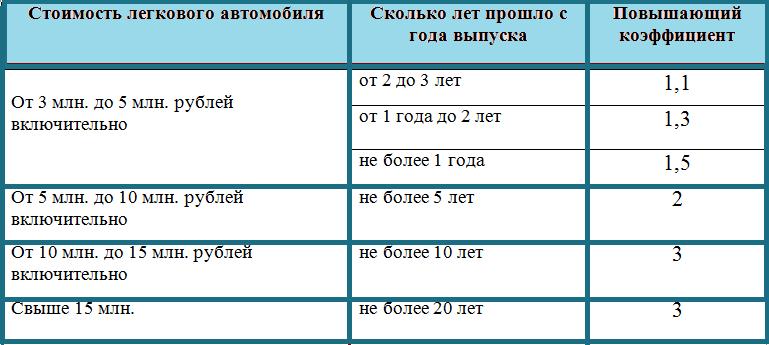

In some cases, it may be necessary to clarify the rate of tax increase. It is necessary if the owner of the vehicle has luxurious movable property.

Having all these data, you can very quickly and successfully calculate the transport tax in Voronezh and other regions of Russia. True, it is better to use a special tax calculator for this. About it will be described below.

Formulas for calculating

It is not as difficult to calculate and pay the transport tax in Voronezh and the region as it might seem. The main thing is to get certain information about the car, as well as remember the formula for calculating the tax on the car.

To calculate your car tax, we recommend that you follow these steps:

- Multiply the tax rate by the number of “horses” in the engine.

- Divide the months of vehicle ownership (per year) by twelve.

- Multiply the indicators obtained in the course of previous calculations.

The amount released - this is the tax on the car. If we are talking about luxury vehicles, you will need to multiply it by a factor.

The concept of luxury vehicle

Transport tax in Voronezh can be paid in the same ways as in other regions of Russia. True, this will have to be done within a certain time frame, otherwise serious problems cannot be ruled out. Especially if you put off the transfer of money to the state treasury for a long time.

Luxury vehicles are recognized as cars listed in the relevant list by the Ministry of Industry and Trade. It is formed and adjusted annually. In these, it is customary to include vehicles worth more than three million rubles.

This is not the price in the DCT, but the cost from the manufacturer. Due to the jump in the dollar exchange rate, ordinary cars, which can hardly be called elite, are increasingly referred to luxury transport.

About bids

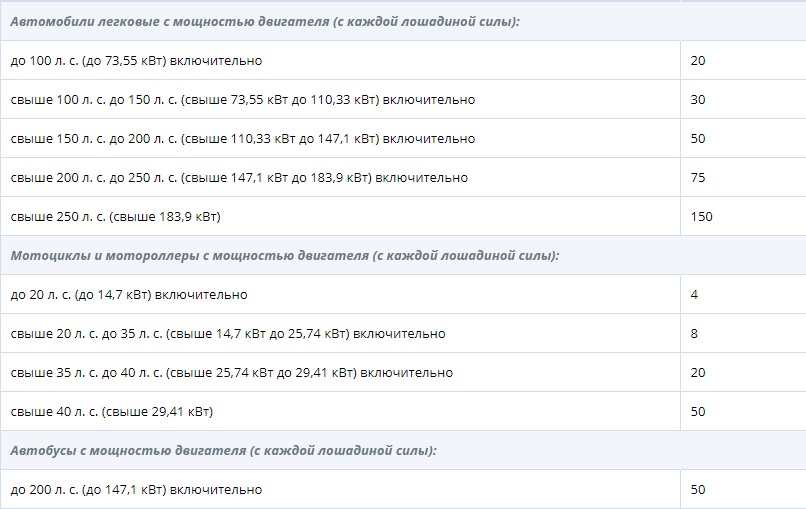

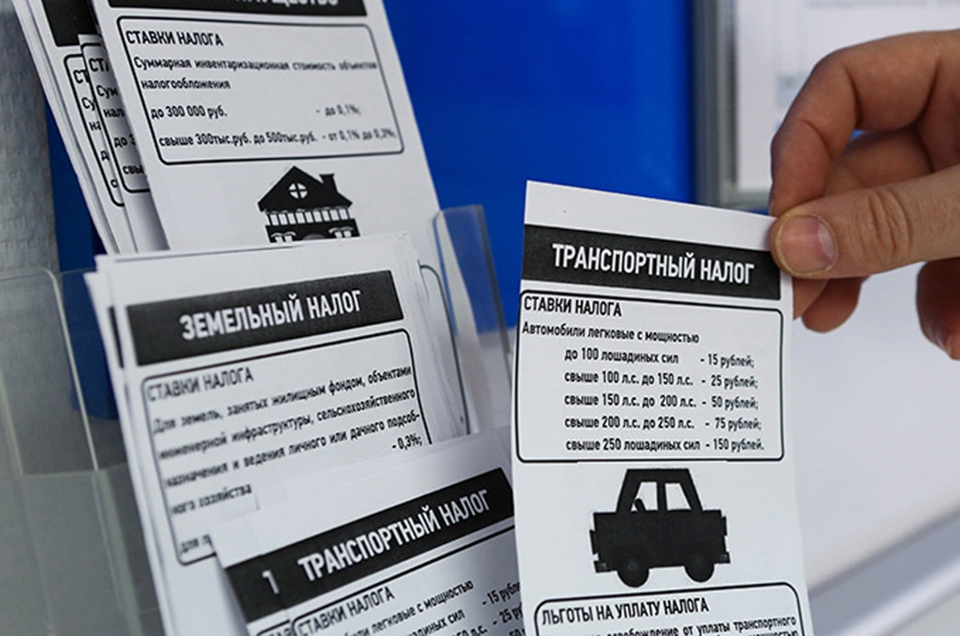

The tax rates for Voronezh in 2019 are presented below. They help to understand how much to pay for a car in property for 2018.

Tax rates are also formed annually. As a rule, they rise. It is worth remembering that the more powerful the transport, the more you will have to pay for it.

Tax exempted transport

As already mentioned, when calculating a car tax, it must be taken into account that certain categories of vehicles based on federal damage are exempt from taxation. This is quite normal. True, not everyone can take advantage of such powers.

Not to pay transport tax is allowed for:

- vehicles equipped for use by persons with disabilities;

- state cars;

- cars, ships and aircraft of special services;

- movable property acquired with the help of social services (if there are no more than 100 "horses" in it);

- freight and passenger transport.

You also won’t have to pay for a vehicle that was stolen. The main thing is to inform law enforcement authorities about this event in time. Otherwise, taxes will be charged according to general principles.

Senior Citizens and Cars

Do pensioners pay transport tax in Voronezh? In general, older people are Federal beneficiaries. Only with regard to transport tax, such a principle does not apply.

The thing is that in most regions of the Russian Federation, the tax on vehicles must be paid even by pensioners. And in Voronezh as well. Nevertheless, older people have the right to use the benefits associated with the capacity of transport.

Taxpayer Benefits

It is also worth remembering that in Russia, transport taxes provide for various benefits. And they depend not only on the capacity of the transport, but also on who the taxpayer is.

For example, benefits for transport tax pensioners in Voronezh are provided on a common basis. They can count on:

- heroes of the USSR and labor;

- veterans - if vehicles with a capacity of up to 120 "horses";

- disabled people who received their status during the war;

- liquidators of accidents and participants in nuclear tests - when vehicles with a capacity of not more than 120 liters. with.;

- large families;

- single parent, if he brings up from 5 children and owns a car in 150 "horses".

It should be noted that the privilege is provided only for one vehicle. In the case of large families, only one parent can apply for them.

Old transport

Transport tax to pensioners in Voronezh have to pay on a common basis. Only they are more likely to receive regional benefits.

What to do with old cars? At the moment, you can not pay for a vehicle that was released more than 25 years ago. The same applies to motorcycles and scooters produced in the USSR. A transport tax for disabled people in Voronezh also takes place, but it applies not only to an old car.

How to make out

Many are interested in how to apply for a tax on a car. This is a fairly simple task, but you will have to prepare for it.

It must be remembered that the corresponding state "bonuses" are indicative. This means that until the citizen himself applies for them, benefits will not be granted.

To achieve the desired goal, you will have to go to the IFC or the regional tax service. The citizen has to perform the following actions:

- Prepare documents for the implementation of the task.

- Fill in the application for the provision of the prescribed benefits.

- Submit an application together with documents prepared in advance.

- Wait a while.

It is done. As a rule, if everything is done correctly, the citizen will be provided with the requested benefit. Otherwise, the applicant will receive a written refusal justifying the relevant decision. At any time, you can correct the situation and again request a benefit.

Documents for benefits

You can calculate the transport tax in Voronezh without any special difficulties. And how to apply for benefits on it? This is a more difficult task. And she, as mentioned earlier, requires separate preparation.

The corresponding process is accompanied by paperwork. To request a vehicle tax exemption, it is recommended that you prepare:

- petition of the established sample;

- Identifier of the applicant;

- title documents on the vehicle (recommended);

- certificates confirming the right to benefit.

If a citizen has several cars, he can independently choose which property to apply benefits to. The main thing to remember is that for the whole transport, if there is a lot of it, they won’t be able to issue them with all the desire.

Automatic tax calculation

As it was already emphasized earlier, it is possible to find out in different ways what transport tax in Voronezh will have to be paid in one case or another. For example, calculating the tax on the vehicle yourself. This is not the best choice, it often leads to erroneous results.

That is why Internet users can use special free tax calculators. Similar resources can be found on various information sites. The most reliable is the official page of the Federal Tax Service of the Russian Federation.

A distinctive feature of such a service is the absence of the need to determine tax rates and increasing coefficients. According to the initially indicated data, the citizen will automatically make all the necessary calculations taking into account the current tax rates.

Instructions for working with the calculator

We have already figured out how to apply for transport tax benefits in Voronezh. It’s just not entirely clear how you can make the necessary calculations using an online calculator.

Instructions for achieving the desired goal look like this (consider the example of the website of the Federal Tax Service):

- Visit the official website of the Federal Tax Service on the Internet.

- Switch to the "Services" section. It can be found in the functional menu of the site at the top.

- Click on the words "Tax Calculator".

- Mark the type of tax that you want to calculate.

- Indicate the necessary data in the calculation form. As a rule, the user will have to register information about the cost, year of release, as well as the power of the vehicle and the place of its registration. Nothing difficult!

- Press the button responsible for starting the automatic calculation of tax on vehicles.

That's all. After the actions taken, the amount of tax payable will be displayed on the screen. Even a novice PC user can cope with such an operation.

Conclusion

We studied the benefits of transport tax in Voronezh, as well as how to apply for them. In addition, we were able to generally familiarize ourselves with the tax assessment mentioned. And now it’s clear what to prepare for this or that case. For example, in case of untimely payment of tax.

If a citizen has delayed such a payment, it is recommended that you first pay for the tax on the vehicle, and then pay a fine and fines. Otherwise, there is a risk of increased debt due to interest.

It is important to know that the vehicle tax is not paid not only for the above categories of transport, but also for boats with engine power up to 5 liters. with., and also for rowing boats. Segways and scooters with bicycles are tax deductible. Moreover, such vehicles are not even registered with authorized bodies.

In any case, it is better to specify the most accurate data on automobile tax in each region separately. And in Voronezh as well. The information presented is provided to familiarize yourself with the features of tax assessment. She can change quickly.